The US domestic flat-rolled market was anticipating an uneventful final week of 2010 when the industry was caught off guard by Nucor announcing its fifth increase in less than five weeks time.

Nucor's $1.50 cwt. ($33/mt or $30/nt) price increase announcement on all flat-rolled products on December 28 came as a surprise to industry insiders who were not expecting another announcement until January. The increase, which will likely be mirrored by other US mills in the coming weeks, has been attributed to the rising cost of raw materials, although there has been no additional scrap pricing announcement just yet. However, with one of the harshest winters on record being recorded on the East Coast and growing demand from steel mills resulting in tight scrap supply, predictions of how large the next increase will be vary anywhere from $30-$60/lt.

With this $30/nt flats increase, Nucor's asking prices are now up to $37.00 cwt. ($816/mt or $740/nt) on hot rolled coil (HRC) and $42.00 cwt. ($926/mt or $840/nt) on cold rolled coil (CRC) and hot dipped galvanized (HDG) and Galvalume base products. And once the current idleness in the steel marketplace subsides after the end of the holiday season, and order activity picks up once again in the new year, spot prices in the domestic flat-rolled market are expected to move even higher.

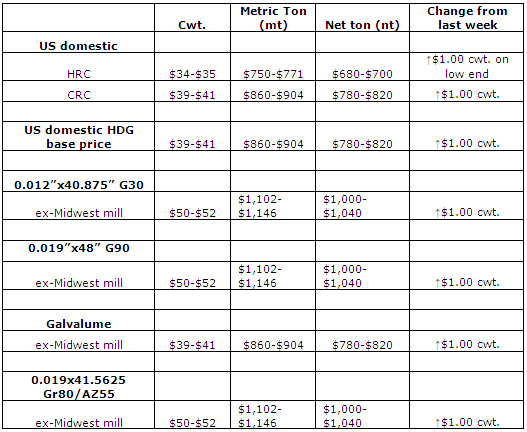

Although there has been little-to-no activity this week, spot prices on HRC are up approximately $1.00 cwt. ($22/mt or $20/nt) on the low end since our last report a week ago, and are now $34.00-$35.00 cwt. ($750-$771/mt or $680-$700/nt) ex-Midwest mill. Spot prices for CRC, which continues to be a "hot commodity" according to market sources, are up $1.00 cwt. to $39.00-$41.00 cwt. ($860-$904/mt or $780-$820) ex-Midwest mill.

Coated prices are up as well and spot prices for HDG and Galvalume base products are now $39.00-$41.00 cwt. ($860-$904/mt or $780-$820/nt) ex-Midwest mill, while the price of coating extras is now in the $50.00-$52.00 cwt. ($1,102-$1,146/mt or $1,000-$1,040/nt) range. How many more increases mills will push for is uncertain, although one thing is guaranteed: once other mills begin rolling out increases of their own and scrap prices move higher as well, bookings at the lower end will begin to quickly fade. Nevertheless, with most sources indicating that their inventories are well-stocked for most of Q1, prices may begin to soften come March if no significant uptick in demand is observed and order books begin to dry up.

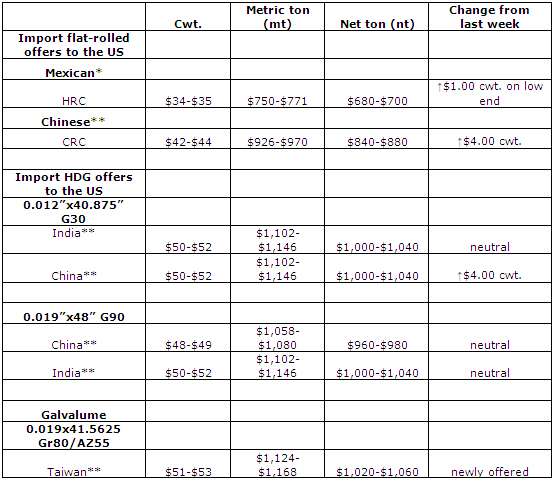

Looking to imports, offers from Mexican mills of HRC have increased once again to match US prices, while some offshore offers have risen significantly over the past week. Chinese prices had the most dramatic increase as the country's offers of CRC and HDG 0.012" by 40.875" G30 are each up $4.00 cwt. ($88/mt or $80/nt) over last week's previously reported ranges. There is still little interest in some of the higher priced import offers, however that may change in Q1 if the price run-up continues in US prices.

*FOB loaded truck delivered to Houston ports

**Duty-paid FOB loaded truck in US Gulf ports