The weak demand due to the continuous decreasing trend seen in the Turkish flat steel market since the middle of July, the influence of the holiday period in Europe and the commencement of Ramadan shortly afterwards have all contributed to both the price softening in Turkey's domestic market and the price drops seen in import offers.

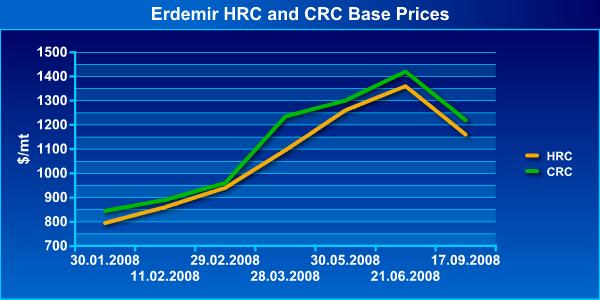

Erdemir, who had not changed its listed prices since June, this week announced new figures. The producer adjusted its base prices for HRC to $1,160/mt, its CRC base prices to $1,220/mt and galvanized coil to $1,350/mt. In addition, Erdemir decreased its prices of ex-stock materials on 19 September. The changes in base prices issued by Erdemir since January 2008 can be seen in the following graphics:

No official announcement has been issued by the Russian mills for the Turkish market, though it is likely that they will make announcements in the months ahead. Meanwhile, it is expected that the Ukrainian mill Zaporizhstal will announce offer levels to Turkey for its October production in the coming days. Traders' offers for HRC produced by Ukrainian mill Ilyich have decreased to levels of $700-750/mt. Also, the most recent offer of Bulgarian mill Kremikovtzi to Turkey is at €610/mt ($867/mt) CFR Turkey, but demand has not yet been seen at this level. Although the Hungarian mill Dunaferr recently offered HRC to Turkey at the level of $1,040/CFR Turkey, currently it is heard that Dunaferr seems to be willing to accept requests at lower levels.

While many offers from overseas mills and traders are seen in Turkey's domestic market, the current sluggishness of demand and the high levels of stocks in this market are forcing importers to wait. The developments seen upon the conclusion of Ramadan will give a better idea of the overall performance of the market.