SteelOrbis has learned from market sources that in the past three weeks local prices in the Spanish flat steel market and import offers to the country have remained unchanged. Market sources state that flat steel demand in Spain is steady.

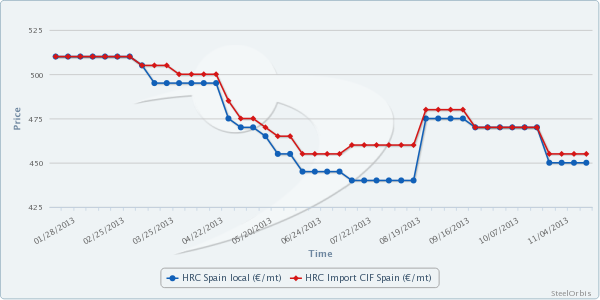

Accordingly, local hot rolled coil (HRC) prices in Spain are still standing at €450-455/mt ($607-614/mt), while domestic cold rolled coil (CRC) and local hot dip galvanized (HDG) coil prices are at €530-535/mt ($715-722/mt). All prices are ex-works and for December production.

On the other hand, import offers from Brazil, India, China and the Middle East to Spain for December shipments can be found at €455-465/mt ($614-628/mt) CIF for HRC, at €525-530/mt ($709-715/mt) CIF for CRC and at €485-495/mt ($655-688/mt) for hot rolled pickled and oiled (HR P&O) coil.

€1 = $1.35

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.