Chinese origin HRC offers to India for 3-12 mm material have increased by $30/mt compared to three weeks ago and are now standing at $550/mt CFR India.

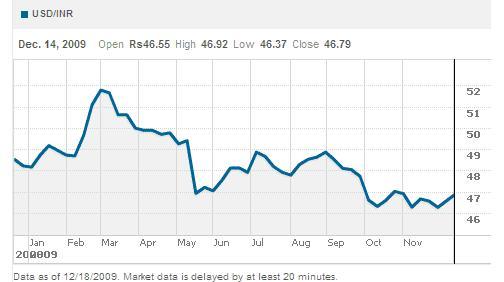

In the local Indian flat steel market, Indian production 2 mm HRC ex-works prices are at INR 27,000-27,500/mt excluding duties - down INR 1,750/mt compared to last month. Calculated based on today's currency rate, the abovementioned decrease is equal to $37.53/mt. But why do the Indian producers keep lowering their ex-works prices in local currency at a time when Chinese offers are losing ground? The answer lies in currency rate fluctuations and weak local demand. To be more specific, since the peak strength of the US dollar on March 2, 2009, the Indian rupee has more or less been continuously appreciating against the US currency.

So despite the fact that Chinese offers no longer pose any threat to the local Indian market, weak demand and the strength of the local currency against the dollar have led to declines in ex-works price levels. With all duties included, Indian domestic market prices are no longer higher than the Chinese numbers; and one should note that three weeks ago the price gap between domestic material and Chinese imports stood at $60/mt.

Local Indian flat steel producers hope that ex-China offers will maintain their uptrend; thus, the Indian producers will not be obliged to make new price adjustments.

On the other hand, some market players think in general that no significant decreases in ex-China flats offers should be expected due to the pressure on profit margins caused by the lack of any great softening in costs of raw materials (such as coking coal and iron ore), with even some uptrends being observed in spot market prices for these raw materials.