The price rises expected to be announced in the first quarter of 2008 have already started to be seen in the Turkish flats market, which continues its uptrend started in early December. In our previous analyses, we mentioned that the rise might start in mid-December; however, price rises started to be seen in early December.

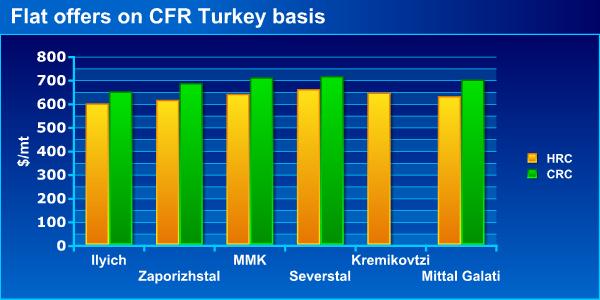

Hot rolled coils ex-Ilyich mill of Ukraine are being offered to Turkey at $600-605/mt CFR Turkey for February shipment. On the other hand, cold rolled coils ex-same mill are being offered to Turkey at $650-660/mt CFR Turkey, also for February shipment. However, currently, there are no Ilyich products available in Turkey. Moreover, the prices of Ilyich production materials are expected to rise in the upcoming period.

Zaporizhstal, another Ukrainian steelmaker, announced its hot rolled coil offer price for Turkey as $615/mt CFR for late February shipments. On the other hand, the offer level for cold rolled coils to the same destination was announced as $685-690/mt CFR, also for late February shipments. However, the producer's order book for both products has been filled. There is an increase of $30/mt and $40/mt in the prices of HRC and CRC, respectively, as compared to the prices announced last month.

Although no official announcement has been made for the flat products of Russian steelmaker MMK, it is heard that the market levels for the producer's hot rolled and cold rolled coils are at $640/mt CFR Turkey and at $710/mt CFR Turkey, respectively, for February/March shipments. There is an increase of $10/mt and $30/mt in the prices of HRC and CRC, respectively, as compared to the prices announced last month.

Hot rolled coils ex-Severstal mill of Russia are being offered to Turkey at $660/mt CFR Turkey for March shipment. On the other hand, cold rolled coils ex-same mill are being offered to Turkey at $750/mt CFR Turkey, also for March shipment. The products, whose prices have been adjusted thrice so far in December, have been lately offered to the market at the levels indicated above. There is an increase of $25/mt and $50/mt in the prices of HRC and CRC, respectively, as compared to the prices announced last month.

Bulgarian steelmaker Kremikovtzi production hot rolled sheets were sold to Turkey at $660/mt CFR for February shipments. On the other hand, the producer's hot rolled coils were sold to the same destination at $645/mt CFR for March shipments. However, the producer's order book for both products has been filled. The prices of Bulgarian origin products are also expected to rise in the coming period. The CR materials of this producer are still out of the Turkish market.

The Turkish market is giving signals of further strengthening after the religious holiday and the New Year. On the other hand, the European market is expected to rise after mid-January.