Demand in the Turkish hot rolled coil (HRC) market has remained unchanged since Ramadan holiday and it continued its weak trend. However, market players state that overhaul works continue on the main automotive industry and subcontractors side and most of the market players are still on holiday. HRC prices in the Turkish domestic market have increased by $5-10/mt as compared to the pre-holiday period.

Increases in HRC prices in the Turkish domestic market are attributed to the stable producers' prices during the Ramadan holiday and expectations for demand to rise after the holiday. Market sources report that, demand has failed to improve due to continuing annual overhaul works and holiday atmosphere. Additionally, demand for producers' material is strong and demand in the spot market is expected to increase. Meanwhile, tight availability of hot rolled pickled and oiled coil has come to a halt but it continues for HRC products.

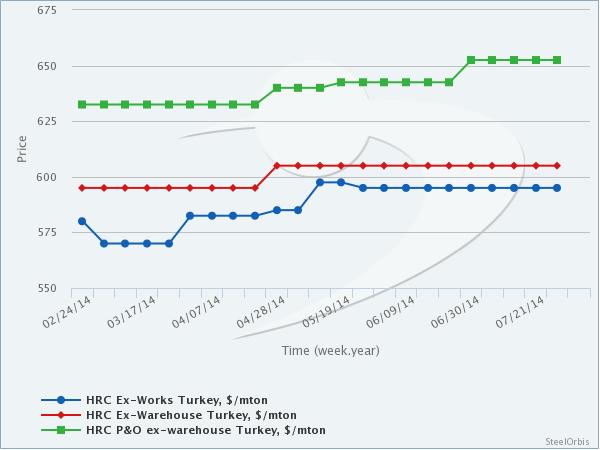

On the other hand, producers' prices have trended sideways since Ramadan holiday and are still at $590-600/mt ex-works. Some producers have filled their order books for September and have started to receive orders for October. Market sources state that $5/mt of discounts are available during transactions and demand for producers' HRC is strong.

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 610-620 | 615-625 |

2-12 mm HRC (for large volume sales) | 600-610 | |

1.5 mm HRS | 640-650 | 645-655 |

3-12 mm HR P&O | 650-660 | 660-670 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.