The crude steel imports of the EU-27 countries decreased by 45 percent year on year in the first half of 2009, and it is expected that the figure for the whole of 2009 will be down 40 percent compared to 2008. Nevertheless, imports to the region in question are expected to rise by 24 percent in 2010 and by ten percent in 2011. The continuing strong competitiveness of flats export offers from countries which are over-producing is cited as the main reason behind this expectation. Despite some recovery in the local Chinese hot and cold rolled steel markets, players think that concerns in relation to Chinese flats exports are legitimate. For example, in the last week ex-China HDG offers to certain markets in the Middle East and Europe were heard at $690-760/mt CFR. Meanwhile, according to the latest data, HRC stock levels in China have increased by fourteen percent year on year. In addition, it seems obvious that the Chinese mills, which seem destined to close 2009 with over 500 million mt of general steel production, are unlikely to exit the export markets. With global steel production (all products included) in 2009 likely to reach 1,200 million mt, overcapacity of around 100 million mt is expected. As a result, the supply-and-demand balance in Europe is likely to come under threat from increased flat steel imports.

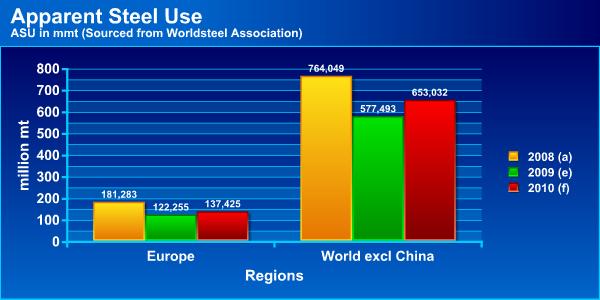

On the other hand, steel consumption in EU-27 countries was down 8.2 percent in 2008, with declines of 32.6 percent and12.4 percent predicted for 2009 and 2010 respectively. Additionally, according to the World Steel Association (WSA) figures, crude steel production in the EU-27 countries in the first nine months of 2009 amounted to 97.1 million mt, down 39.3 percent compared to the same period of 2008.

As seen in the above graph, apparent steel consumption in the EU-27 countries is unlikely to reach the 2008 figure of 181.2 million mt in 2010.

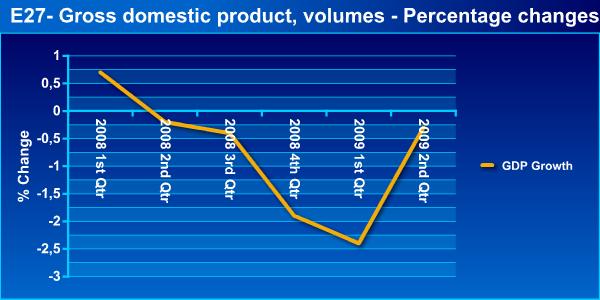

Meanwhile, according to the Eurostat figures, GDP growth data for the EU-27 region in the second quarter of 2009 softened by 0.3 percent. On the other hand, some hope has been offered by positive results such as the 0.3 percent increase in locomotive markets (e.g., in Germany and France) due to increased public expenditure. However, in conclusion, it seems that other European countries, including Bulgaria, Spain, Romania and the Baltic countries, have still not managed to shake off the effects of the crisis.