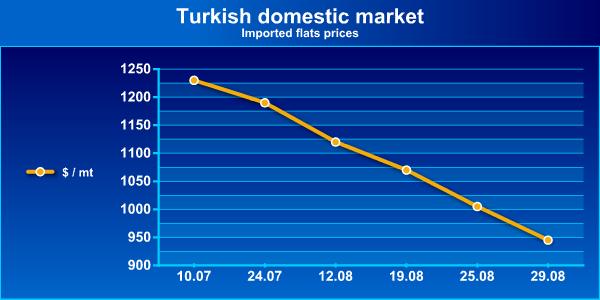

As reported by SteelOrbis in previous analyses, the current liquidity shortage in addition to the low demand in the Turkish domestic market continues to draw prices down. However, it would not be entirely wrong to say that the main reason behind this decline is the insufficiency in demand. Well, is this low level of demand normal? Turkey - a country that is mainly dependent on the international markets - is being directly affected by the offshore prices. Currently, import prices for Russian, Ukrainian and Romanian production materials to Turkey have all gone down to very low levels. For example, it is known that a Russian steelmaker made its HRC offers to Turkey this week at the level of $960/mt. As a result of all these developments, all the firms that are experiencing shortage of liquidity have been continuously reducing their prices solely for the purpose of selling material. The situation is such that there are companies that have even made three successive reductions to their prices within a single week. In order to get a better idea about the average change in domestic prices, the changes in the past month can be seen in the chart below:

While the equilibrium of the Turkish domestic market is very sensitive, the main factor helping to prevent a breakdown is Turkish integrated steelmaker Erdemir's firm stand. Erdemir has not made an adjustment to its price list and has provided a certain amount of discount for companies that have given orders for the last quarter. These two factors have given some relief to the market and prevented a rapid drop. Nevertheless, a drop of around $150/mt has been observed in domestic prices in the past four weeks. These developments have naturally caused many firms - the ones that have been waiting for purchases of material - to take a longer lasting "wait-and-see" attitude. As the continuous decline in prices is supporting all expectations that prices will continue this way, the companies likely to make moves to purchase are not so eager to make price inquiries, where the need is not urgent.

In addition to all these developments, the most important point to be remembered is the arrival of Ramadan. As is known, under normal conditions, business activities in Muslim countries all slow down during the month of Ramadan. We experienced this last year, as well as in the previous years. The prevalent opinion in the market is that this downtrend in prices will continue till mid-September and that purchases will only start if business activities recover following the end of Europe's holidays. However, another idea is that business activities will almost come to a halt during the Ramadan as well as during the last quarter, that this year prices will stabilize only after bottoming out, and that they will rise again with the New Year bookings. The actual path the market takes is entirely dependent on developments in the global situation, in addition to the moves by world economy giants such as the US and China. In particular, the steps to be taken by China in terms of taxation should be tracked carefully.