Market players got worried against the rumors of an approaching economic crisis in the Turkish market. The US dollar which started to climb against the Turkish lira also contributed to the worries. However, as the US dollar regressed to some extent towards mid-week. While the economic crisis is overwhelming Europe, the current account deficit of Turkey has signaled the US dollar will maintain its strength over the Turkish lira for some more time. By the end of the week, the market has found some relief after the Turkish authorities explained they expect Turkey to receive a minimum impact from the said crisis. In view of such an environment, some traders have halted their flat rolled steel purchases for a short period of time.

In the Turkish domestic market, prices have not changed significantly compared to last week. The seasonally low demand level has not recovered at all, while volumes and product variety at inventories have started to get narrower, preventing prices from losing ground. Erdemir is collecting offers for October, while Colakoglu is expected to restart production in August, following the maintenance at its mill. The average offer level of hot rolled coils by producers such as Erdemir, Colakoglu and MMK-Atakaş are currently at $750/mt ex-works.

This week spot prices in the market for hot rolled coils have been at $760-770/mt ex-warehouse, and cold rolled coils of 1-1.5 mm thicknesses have been at $890-910/mt ex-warehouse. Thinner gauge cold rolled coil prices have been at $930-960/mt ex-warehouse.

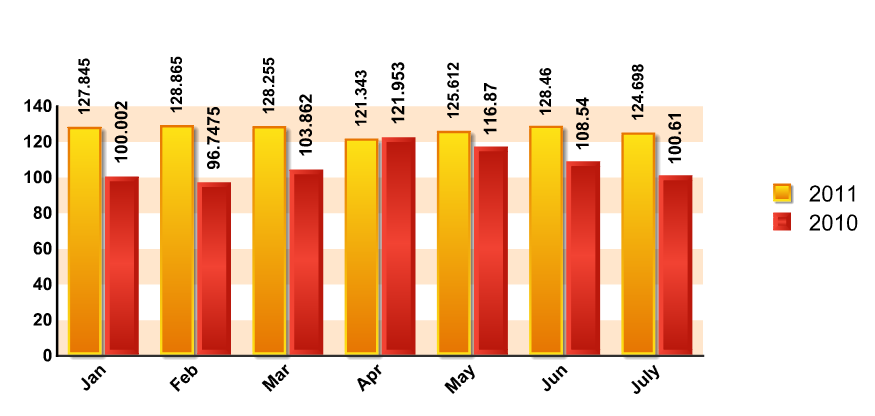

Orbis Steel Index - Hot Rolled Coil Index

According to the Turkish hot rolled coil index of Orbis Steel Index (OSI), the index dropped four points in July 2011 over June 2011, having dropped by 8 points in the same period last year. When we compare the first half of years 2010 and 2011, we see that prices of hot rolled coils are 20 points higher compared to last year. In the month of April alone, the indices were at similar levels for both years, and the softening that lasted from April to July last year has not occurred this year. In this framework, we see a more consistent flat rolled market in 2011.

As hot rolled coil is produced by a variety of producers in the Turkish market, traders and end-users prefer booking from the domestic market and the volume of imports gets narrower. According to the traders' point of view, the market has gained consistency thanks to the increasing portion of domestic buying activity and aggressive offers by domestic producers.