Contagion, which is the spreading of unfavorable financial conditions in one part of the world to others, is growing like a virus because of the continuing stream of negative economic and political developments. In turn, since new fixed asset investment (FAI) projects are often based on confidence about the future, WSD thinks that FAI globally this year will probably decline as a share of global GDP. Consequently, WSD sees little possibility for a significant rise in steel demand in 2014 because fixed asset investment is the primary driver of global steel demand. We now expect that global steel production this year will be little changed from 2013’s 1.609 billion tonnes.

The outlook for global fixed asset investment (FAI) in 2014 has deteriorated. In fact, even before the recent crisis in Ukraine, the prospect for a sizable rise in FAI was low in WSD’s opinion. Any slippage in FAI, of course, is a huge negative for steel demand since it accounts for about 90% of Chinese steel demand and more than 80% elsewhere. The Fixed Asset Investment Flywheel may rotate no faster than in 2013 because the start-up of new projects may lag the pace at which the backlog of existing products is worked off:

• In China, while reported FAI may rise 13-18% this year, including the value of land sales and M&A activity, it’s likely that the rise in GFCF (gross fixed capital formation) will be far less assuming: a) some slowdown in residential construction activity, which accounts for 25% of the country’s FAI; and b) a fair portion of the recent sharp rise in RMB-based loans occurred based on the refinancing of existing municipalities’ one-to-three-year loans.

On the political front, China’s search for dominance of the South China Sea region, and the protection of its ocean-borne trade routes, could lead to economic disruption at any time.

• Outside of China, we think that contagion – which is the spreading of negative financial conditions in one part of the world to others – will add to political and economic uncertainty and reduce the confidence about the future that’s so essential when new FAI commitments are made. Here are four examples:

- The political/economic/military crisis in Ukraine, including Russia’s actions to prevent the new Ukrainian government from controlling the Crimean Peninsula, where Russia has a major all-weather Black Sea port and there’s a preponderance of Russian-speaking people. The Ukrainian government may have a $35 billion shortage of funds at the present time.

- The “Arab Spring” that has manifested itself in a wave of revolutionary demonstrations and protests to overthrow the existing order. Subsequently, like wild fire, protests have spread through much of the Arab world including Egypt and Libya where existing governments were ousted. Protests briefly flared up in Iran. In a number of countries, economic activity has been severely disrupted and fixed asset investment inhibited. The Arab Spring is still in force as evidenced by the three-year civil war in Syria.

- The lingering impact of 2010’s Eurozone sovereign debt crisis – a situation still stressful to many observers even though the European Central Bank is now stepped in with what, in effect, are loan guarantees. Nearly three years later, many of the EU “peripheral” countries have stretched finances, insufficient funds and no prospect for an immediate strong recovery in fixed asset investment.

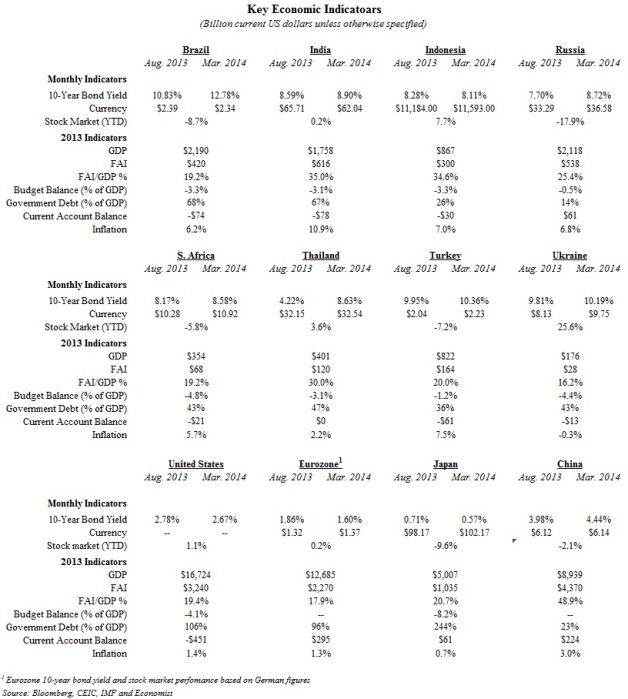

- The weakening of many non-Chinese Developing World currencies in the past six months is impacting these countries’ economic prospects and, at the same time, is dampening the enthusiasm to invest in these countries. Policymakers in a number of the countries have boosted interest rates in an attempt to protect their currency and combat inflation. Foreign direct investment may be reduced. On a home-currency basis, U.S. dollar-denominated debt obligations have risen because of the weakened currency. Overall, WSD thinks that much of the non-Chinese Developing World economy is a “basket case” at the present time – with aggregated steel demand, at best, to rise only moderately in 2014.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved