Capital spending by the Chinese steel industry in 2012 was about $80 billion, which was enough to keep Chinese capacity rising at perhaps a 4 percent rate. In 2013, although capital outlays year to date are up about 4 percent we estimate that the figure for the year will decline to about $78 billion.

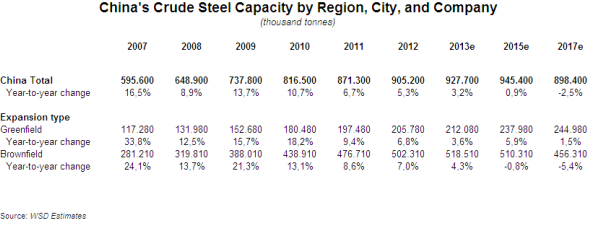

China's effective (real) steelmaking capacity in 2013 is estimated to be about 930 million mt, up about 25 million mt from 2012. In 2014, perhaps capacity may rise to about 950 million mt. Given our estimate that Chinese steel output in 2013 will be 770 million mt, the industry's effective-capacity operating rate is about 80 percent. Moreover, many of the larger steel plants - i.e, the CISA members - are partly owned by municipalities. Besides appointing the top manager at the steel company, the municipality is interested in sustaining output in order to keep up employment and receive their 25 percent share of the VAT revenues (with the VAT amounting to 17 percent of sales).

Two new 10 million mt per year "Greenfield" plants on China's southern coast have been approved for construction - which are the Baosteel's Zhanjiang project and Wuhan Steel's Fangcheng projet. There used to be four central government-owned steel mills, Baosteel, Wuhan, Panzihoua and Angang. Panzihoua was consolidated into Angang, with the three remaining central government-owned mills given initial approval to build steel mills on the South Coast. And, because the companies are controlled by the central government and not a municipality, there was no problem in locating new capacity to other regions.

Angang did not get final approval to build a steel mill on the coast because its losses on recent expansions have been so sizable. Instead, it's building a distribution center to serve the automotive and appliance industries with the steel coming from the company's steel plants in the north.

For additional information of WSD's services, please contact us at:

wsd@worldsteeldynamics.com

Or visit our website at:

www.worldsteeldynamics.com