WSD has a theory it calls "Oversupply Equilibrium." The assumption is that when oversupply is moderate to substantial, the world hot-rolled band price, ex-works, has a tendency to decline to:

- The operating cost of the median-cost non-Chinese mill.

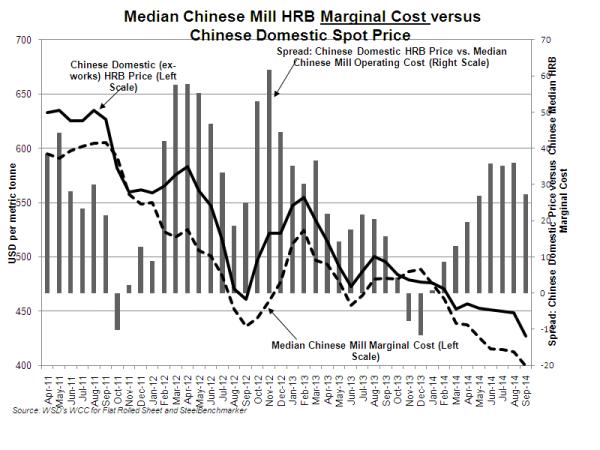

- The marginal cost of the median-cost Chinese mill. In this case, the price may remain at marginal cost for a relative long time, which would normally not be expected, because Chinese steel production is so "sticky" on the downside.

A pricing "death spiral" on the world market - i.e., when the price falls to the marginal cost of the median-cost mill - is not a long-lived event (i.e., it's a short age) because it forces some of the mills in the third cost quadrant, and many in the fourth cost quadrant, to cut back output. In general, death spirals are susceptible to occurring when the price of the hot-rolled band is elevated and buyers' inventories are so high that, once the buyers fear the price may decline, there's a marketplace "chill" - i.e., a dearth of orders - that can persist for two months or more. As a consequence, the price plummets until it hits an unsustainable low that's rarely in place more than six weeks, if that.

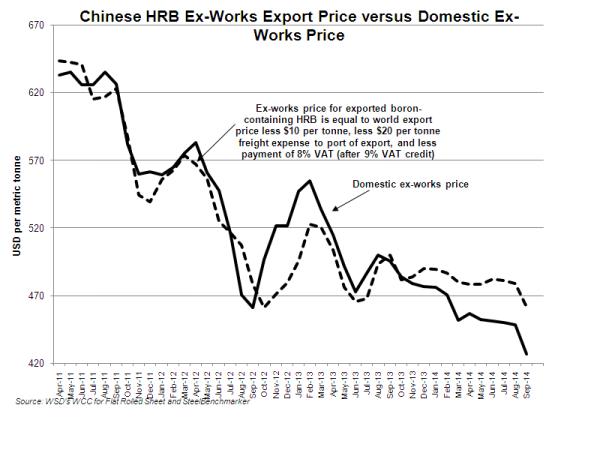

In the accompanying exhibit, we plot the marginal cost of the median-cost Chinese mill against its ex-works export price realization after taking into account: a) the cost to ship the steel to the port of export and load it on the boat, plus other costs; and b) pay an 8% value added tax on the steel assuming it contains some boron (which means that, at least for the present, it doesn't pay 17% because there's a 9% value-added-tax credit). The price is assumed to be equal to our assessment of the world export price for hot-rolled band less $10 per tonne - which, as of September 2014, is about $430 per tonne ex-works (and about $490 per tonne, FOB the port of export).

As of September 2014, the Chinese export price is highly depressed in the eyes of many people in the marketplace; yet, it's still about $27 per tonne above the marginal cost of the median-cost steel mill (with that premium portrayed in the right hand bar in the exhibit).

The median-cost Chinese mills' cost, of course, has fallen sharply the last six months due to the lower prices for steelmakers' raw materials.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved