WSD believes that it is only a matter of time before the price of steel scrap declines as much as 10-15% versus current levels.

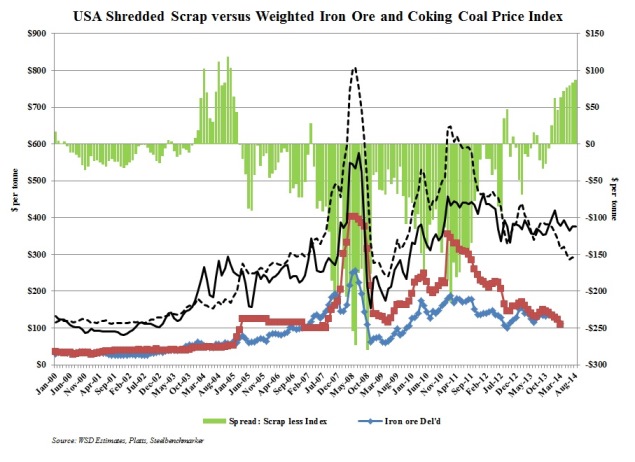

Based on WSD's SteelBenchmarkerTM pricing series, shredded steel scrap delivered to USA mills was $376 per gross ton in early September 2014 versus $360 per gross ton in August 2013. The current price is about 19% below the post-2008 financial crisis high of $466 per ton in January 2012. By way of comparison, the prices of iron ore and coking coal are down far more sharply:

• The current iron ore spot price, delivered to China, at about $82 per tonne is off about 42% from $143 per tonne in early August 2013, and it is down about 57% versus its temporary peak of $191 per tonne in the winter of 2011.

• The price of coking coal, FOB Australia, at about $108 per tonne is off about 24% from $142 per tonne in early August 2013 and about 70% versus the peak of $355 per tonne in 2011 (when heavy rains in northeastern Australia wreaked havoc on the region and created a global shortage).

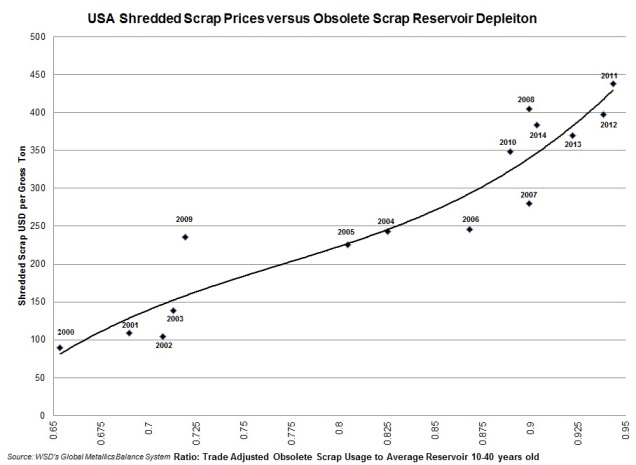

One explanation for steel scrap price’s “stickiness” on the downside is illuminated by the data from WSD's Global Metallics Balance System (GMB). The figures indicate that the global supply/ demand balance for obsolete steel scrap has remained tight by historical standards in 2014 as measured by the ratio of global obsolete scrap requirement to the average size of the steel scrap reservoir that’s on average 10-40 years old:

• The global obsolete scrap demand in 2014 is forecast to increase only 0.2% to 360 million tonnes versus 359 million tonnes last year.

• The average size of the steel scrap reservoir in 2014 that’s 10-40 years old will increase about 2.4% to 398 million tonnes.

• On balance, in 2014, the global steel scrap recovery ratio versus the average size of the scrap reservoir 10-40 years old may decline to about 0.90 versus 0.92 in 2013; but, this is still a high recovery ratio by historic standards.

Based on WSD’s Global Metallics Balances (GMB) historic data, 2014 will be just the fifth year dating back to 1975, in which the steel scrap recovery ratio has been about 0.90 or higher. Each prior occurrence coincided with high scrap prices – as indicated in the accompanying graphic.

The relatively high steel scrap price this year, in the absence of significant demand growth for obsolete scrap, may largely be the result of the exceptional rise in demand for obsolete steel scrap in the past decade; which likely depleted the supply of easily recoverable scrap.

In the coming decade, the GMB system forecasts that the global obsolete steel scrap reservoir will experience exceptional growth while global demand for obsolete steel scrap may stagnate. As a result of this dynamic, the obsolete steel scrap recovery ratio may decline from 0.90 in 2014 to only 0.82 in 2020; and, then, to just 0.73 in 2025. WSD believes the massive rise in the size of the Chinese obsolete steel scrap reservoir 10-40 years old, will sooner or later drive down steel scrap prices.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved