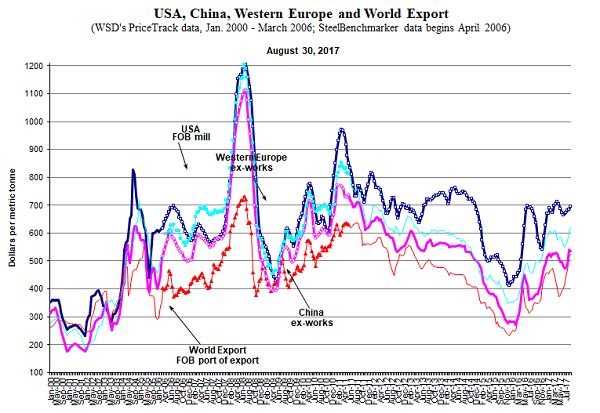

The average price of hot-rolled band on the world market on August 30, 2017 was about $580 per tonne, FOB the port of export. Included in the average was the Chinese mills’ price at about $560 per tonne, FOB the port of export. The Chinese mills’ discount of about $20-30 per tonne versus the higher-priced mills is a relatively small one for them because the steel market is so strong in their country – with the country’s 80+ wide hot strip mills operating at about 95% of capacity according to press reports.

Looking back to mid-April 2017, the HRB export price bottomed out at an average price of about $480 per tonne. However, the variations in export quotes at that time were perhaps the greatest in the history of the industry. Many of the leading non-Chinese international mills were quoting an HRB export price at $490-500 per tonne, and even $510 per tonne in some cases; the Russian mills’ quote was about $460 per tonne at Black Sea ports, say our contacts; but, the Chinese were offering at just $410 per tonne – a whopping $70-80 per tonne less than the offering price for a number of leading international mills (as above).

The mid-April 2017 Chinese HRB export quotation of $410 per tonne, FOB the port of export, was below the marginal cost of the country’s median mill. When subtracting $20 per tonne for the cost to deliver the HRB to the port of export and China’s 8% non-refundable value-added-tax on HRB exports, the ex-works HRB export price was just $357 per tonne – or $39 per tonne below the estimated marginal cost of China’s median-cost mill of $396 per tonne – based on WSD’s monthly World Cost Curve data. The good news for the HRB export marketplace last April, from the viewpoint of the steel mills, is that the world’s leading international mills did not lower their price quotes to match the Chinese price – unlike the situation in December 2015 when a number of the mills matched the Chinese export price of $270 per tonne, FOB the port of export.

How high might the HRB export price rise? As WSD forecast in its last two “Early Warning System” reports, a rise to $600-650 per tonne would be no surprise reflecting: a) the strong demand for steel in China; b) growing demand for steel outside of China; and c) rising steelmakers’ raw materials prices that are prompting buyers to place orders farther ahead in order to avoid likely forthcoming steel price boosts.

Might hot-rolled band rise well above WSD’s targeted upside price of $650 per tonne, FOB the port of export? It’s not very likely in WSD’s view; but, it’s still instructive to look back to July 2008 when a severe steel shortage – i.e., after huge price spikes – was in effect. Here are some examples for prices in mid-July 2008: Hot-rolled band at $1,100 per tonne, FOB the port of export versus $580 at present; USA #1 heavy melting scrap at $515 per tonne versus $285 at present; USA prime steel scrap (busheling) at $880 per tonne versus $380 per tonne at present; pig iron delivered to New Orleans at about at $930 per tonne versus $370 per tonne at present.

The prices in July 2008 were up so substantially that many steel buyers, who were in shock, decided to “sit on their hands” and hold back from placing new orders – in other words, there was a “buyers’ strike.” Hence, by early August 2008, a significant “chill” had developed in the global marketplace.

Combined with other developments including declining global steel demand in the second half of 2008 because of the global financial crisis, the export price by November 2008 for hot-rolled band was down to $595 per tonne, FOB the port of export; for USA #1 heavy melting scrap to $120 per tonne; for USA prime scrap to $158 per tonne; and, for pig iron delivered to New Orleans to $330 per tonne. (Note: WSD’s Inside Track #88, published on July 11, 2008, was titled “Thunderstorm Alert.” In it, WSD boosted the odds to 90% from 85% that world steel export prices would collapse in the second half of 2008.)

SteelBenchmarker HRB Price:

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2017 by World Steel Dynamics Inc. all rights reserved