The huge rise in Chinese pig iron production the past two decades has strongly impacted the relationships between the various components of the global metallics balances system - with the consumption of steel scrap being much lower than would otherwise be the case. Chinese pig iron output now amounts to about 740 million mt per year, or 61 percent of the global total. In 2000, the figures were 128 million mt and 22 percent, respectively. By way of comparison, China's steel production now amounts to about 800 million mt per year annualized, or 49 percent of the global total, versus 130 million mt in 2000, or 15 percent of the global total.

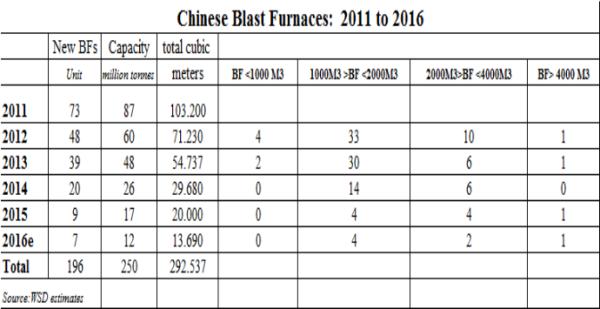

While more than 100 smaller-sized blast furnaces have been closed since 2011 because they were highly inefficient and caused pollution, the construction of larger-sized blast furnaces in China has been prodigious. From 2011 to 2015, 189 new blast furnaces were built with a capacity of 238 million mt per annum, with another 7 planned for completion in 2016 with a capacity of 12 million mt per annum.

China's BOF steelmaking furnaces currently use only 6-7 percent steel scrap in their metallics charge, with much of that being home scrap. What about the future granted an 11 percent yield loss in BOF steelmaking furnaces, the same as at present, and with BOF steelmaking holding at about 90 percent of the total? If Chinese steel production in 2025 is 700 million mt and steel scrap more than doubles to 15 percent of the metallics charge, the usage of steel scrap in the BOF would rise to 105 million mt versus 52 million mt in 2016.

Regarding EAF steel production, if it remains at 10% of China's total and the yield loss is 9.5 percent from metallics to crude steel, steel scrap usage in the EAF would decline to 77 million mt in 2025 versus 88 million mt at present - for a reduction of 11 million mt. On this basis, the net gain in steel scrap usage in the BOF and EAF, assuming no usage of pig iron in the EAF steelmaking furnaces, is 41 million mt.

In comparison, the reservoir of China's obsolete steel scrap that's on average 10-40 years old, by 2025 rises to 219 million mt versus 89 million mt in 2016, for a gain of 130 million mt. If so, it's inevitable that, by about 2020, China will become a significant net steel scrap exporter.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2016 by World Steel Dynamics Inc. all rights reserved