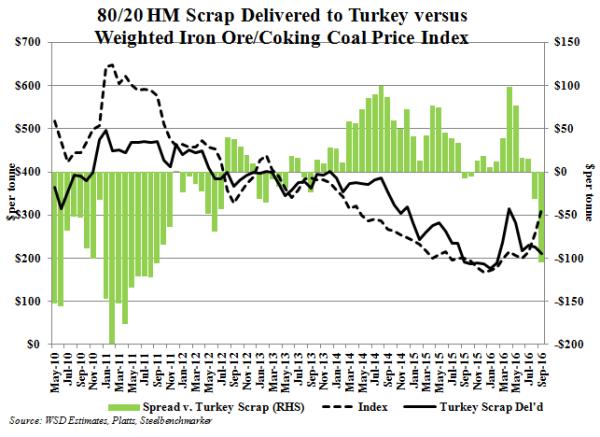

In this graphic, the price of 80/20 steel scrap delivered to Turkey is compared to the weighted iron ore/coking coal price - with the iron ore price being the delivered price to China and the coking coal price being the Australian export price. (Note: We assume 1.6 tonnes of iron ore and 0.9 tonnes of coking coal per tonne of pig iron.)

As indicated, since this spring the combination of the roughly $75 per tonne decline in steel scrap price delivered to Turkey and the $100 per tonne spike in the coking coal price, notwithstanding about a $6 per tonne drop in the iron ore price delivered to China, has resulted in about a $90 per tonne discount in the steel scrap price relative to the weighted iron ore and coking coal prices.

A discount this substantial last persisted in 2014 when USA steel demand rose about 9% and steel production in China, at 823 million tonnes, was up about 100 million tonnes from 2012. And, the U.S. dollar on a trade-weighted basis at that time was about 10% cheaper.

Given the current steel scrap price discount, Turkish EAF-based steelmakers will turn once again to the making rebar in their steelmaking furnaces, rather than converting it from billet that's purchased from China and Russia. That is, if the Chinese billet price rises due to the increase in the coking coal price.

What came first, the chicken or the egg? Or, what drives the steel scrap price, the supply/demand balance or its relative value?

What may cause the "spread" to diminish? If Chinese steel production falls back as we are forecasting, the major driver will be the drop in the coking coal price.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2016 by World Steel Dynamics Inc. all rights reserved