Glass house

Picture this.

The steel industry in each country lives in a glass house. Everything is visible - there are no secrets. Goliath, who is representative of the Chinese steel industry's unprecedented threat to the viability of the non-Chinese steel companies, is circling the house.

What's the necessary action for the non-Chinese steel mills to prevent Goliath from entering the house and destroying it? The needed action is to build a massive cast iron gate that keeps Goliath on the outside.

One might say that, in this new world, protection against offshore steel deliveries is the trump card.

This evolving steel industry structure is not a happy one for some players:

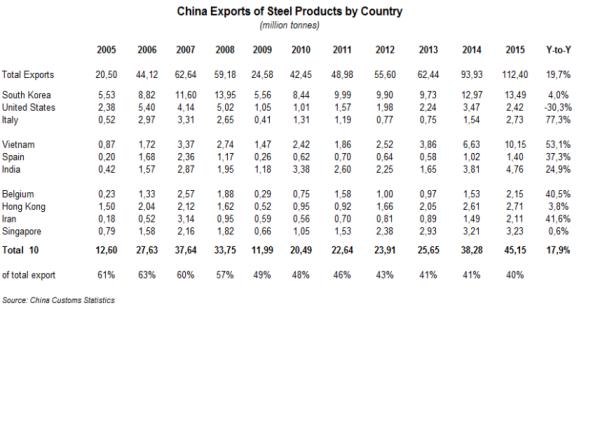

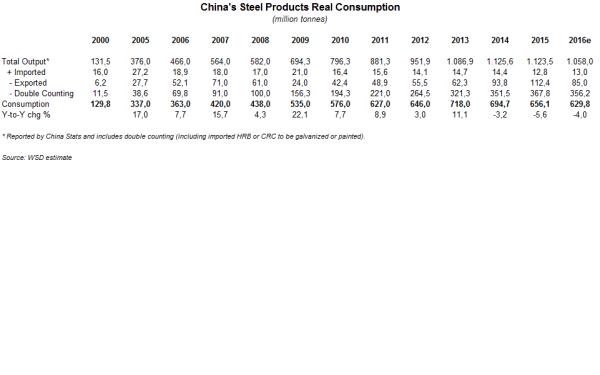

- The Chinese and other sizable steel-exporting companies will be facing import restraints in a growing number of countries, which will greatly reduce their deliveries. Yes, folks, protectionism reduces trade.

- Steel exporting mills delivering only a small portion of their product to affiliated steel-consuming units will find it very difficult to almost sustain exports; and, they will suffer from a lower-value-added export mix than if they had downstream affiliated outlets.

- Steel mills located at deep water ports in the Pacific Basin - there are about 26 of them - will remain in a very competitive exporting environment. For example, a new $11 billion 6 million-tonne-per-year steel plant in Vietnam is starting up with no good market for the higher-end products that can be produced by its state-of-the-art hot strip mill. It also has no ownership of downstream steel processing entities in Vietnam or elsewhere. The profit outlook for this mill, which may face interest expenses of more than $100 per tonne, is quite a challenge.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright Ó 2016 by World Steel Dynamics Inc. all rights reserved