The Old World - Opt for oligopolistic pricing power when the occasion arises

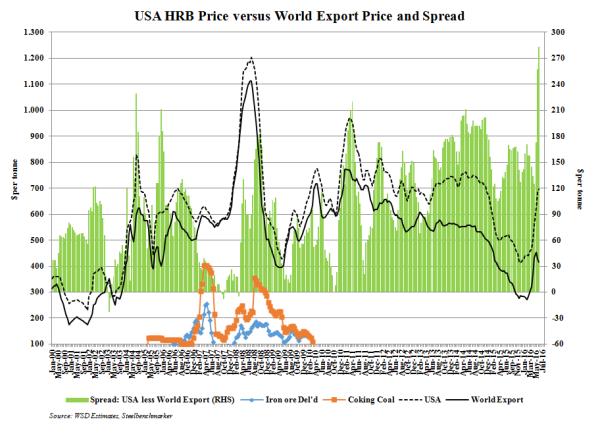

The steel industry was an assemblage of companies whose profitability was driven ultimately by the hot-rolled band price on the world market. Only when the export price was high did most steelmakers have the "pricing power" to pass on their costs. The best profitability occurred when the export price was spiking to a sizable premium; but, this was a "short" age.

Conversely, during periods of crisis when the hot-rolled export price was extremely depressed, industry concentration was fostered by a sharp rise in merger and acquisition activity and plant closings. Increased concentration boosted the mills' pricing power.

This traditional approach to analyzing the industry is no longer working. In the current crisis, the steel industry is "disintegrating." Many multi-plant steel companies are selling off some of their plants, often at a bargain price. The number of independent steel mill competitors vying for the market is rising.

The New World - Protection and mercantilism is the steel mills' friend

In the fourth quarter of 2015, given the Chinese steel mills' willingness to export hot-rolled band at a price 15% below the marginal cost of the average-cost Chinese mill, and a rising number of mills elsewhere opting to match the Chinese price because they could not tolerate a further loss of business on the world market, steel mills in many cases have entered a "financial calamity" condition in which losses are destroying their balance sheets. In desperation, the non-Chinese mills in many cases ran to their governments asking them to enforce the trade laws and take other actions to diminish the impact of the Chinese steel mills' exporting armada. For once, governments listened.

We've now witnessed an unprecedented avalanche of trade suits against steel exporting mills in China and elsewhere. These trade suits, no doubt, will: a) diminish world steel trade; b) drive down the Chinese mills' exports; and c) cause heightened price competition in non-restrained markets.

Protection and mercantilism have become the steel mills' friend. Steel mills in countries with strong import barriers and not so many domestic competitors will increasingly display respectable profits even when the world steel market is slack. This circumstance is extraordinarily evident in the United States in late June 2016 as a "Fortress America" situation.

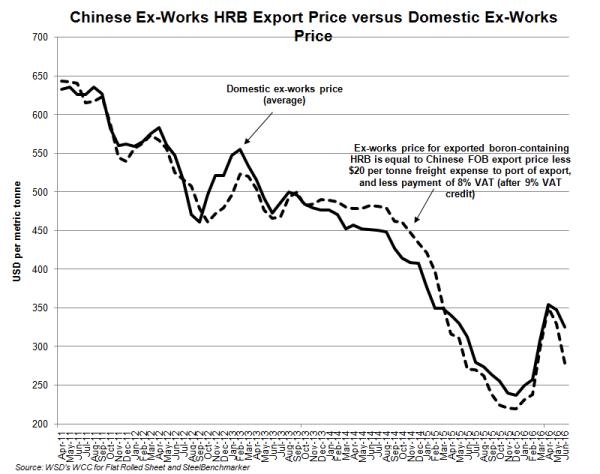

The result of steel trade suits permitting the domestic hot-rolled band price to hold at about $700 per metric tonne compared to: a) the Chinese mills' domestic ex-works HRB price of about $325 per tonne; and b) HRB export price, FOB the port of export, that ranges from a low of about $330 per tonne for the Chinese mills (and, in a few cases for mills in other countries, still about $400 per tonne). The Chinese ex-works export price is now only about $300 per tonne (before payment of the 8% VAT).

With Chinese and non-Chinese steel production in June 2016 fairly well sustained by the run-up in prices in home markets and the world market in January to April 2016, WSD now expects that the HRB export price by late summer to be almost as low, on a cost-adjusted basis, as it was in the fourth quarter of 2015.

The Chinese steel mills are particularly in trouble because: a) their steel production annualized may drop by late summer to 750 million tonnes from a peak of about 850 million tonnes in April-May 2016; b) their exports will fall back; and c) the domestic market is so "competitive," with about 92 wide hot strip mills vying for business, that the mills in most cases have found it impossible to separate their home and export price realizations.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2016 by World Steel Dynamics Inc. all rights reserved