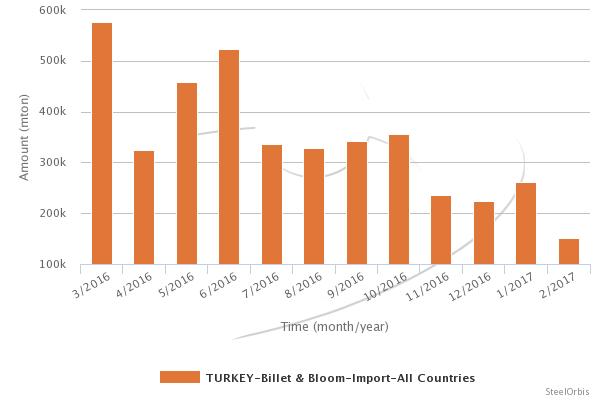

In February this year, Turkey's billet and bloom import volume decreased by 70.2 percent year on year to 150,318 mt, down 42.6 percent compared to the previous month, according to the data provided by the Turkish Statistical Institute (TUIK). The value of these imports totaled $63.45 million, down 55.4 percent year on year and falling by 39.7 percent compared to the previous month.

In the first two months of the current year, Turkey's billet import volume amounted to 412,425 mt, falling by 50 percent, while the value of these imports decreased by 28.8 percent to $168.5 million, both year on year.

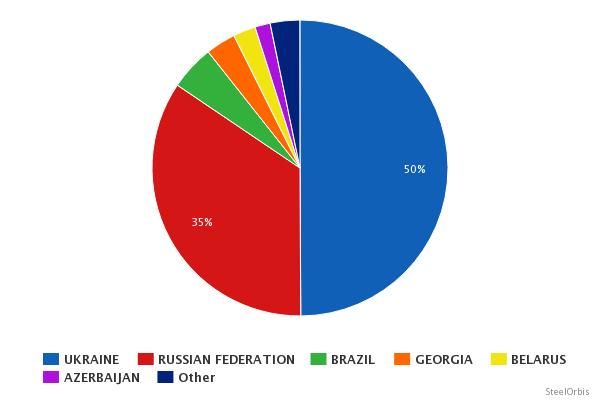

In the given period, Turkey imported 205,884 mt of billet and bloom from Ukraine, down 21.26 percent year on year, with Ukraine ranking as Turkey's leading billet and bloom import source, ahead of Russia which supplied 142,478 mt in the given period.

Turkey's top billet and bloom import sources in the January-February period of this year are as follows:

Country | Amount (mt) | |||||

January-February 2017 | January-February 2016 | Y-o-y change (%) | February 2017 | February 2016 | Y-o-y change (%) | |

Ukraine | 205,884 | 261,478 | -21.26 | 91,947 | 132,167 | -30.43 |

Russia | 142,478 | 231,569 | -38.47 | 33,123 | 152,261 | -78.25 |

Brazil | 20,167 | 29,812 | -32.35 | 15,199 | 25 | - |

Georgia | 13,537 | 2,147 | 530.51 | 5,206 | 2,147 | 142.48 |

Belarus | 10,138 | - | - | - | - | - |

Azerbaijan | 6,871 | - | - | 1,493 | - | - |

Turkey's main billet and bloom sources on country basis in the first two months of this year are presented below: